Why This Matters

If a backtest seems to “forecast” the future without any explanatory edge, it probably does. The culprit is usually look‑ahead bias: using information you could not have known at the time of the decision.

Below are the most common categories, each with a tiny example and a safe fix. These patterns appear in Backtrader, MQL (MetaTrader), PineScript—really in every language and engine.

1) Using Future Bar Values

Symptom: The strategy decides using the current bar’s final values (like Close) and assumes an execution that benefits from that same bar’s information.

Backtrader (risky):

def next(self):

# Deciding on the close and (with coc=True) filling at the same close

if self.data.close[0] > self.sma[0]:

self.buy() # with cerebro.broker.set_coc(True) this can look ahead

Backtrader (safe):

# Default Backtrader fills on next bar open. Keep it that way for realism.

cerebro.broker.set_coc(False) # ensure no cheat‑on‑close

def next(self):

if self.data.close[-1] > self.sma[-1]:

self.buy() # order fills next bar open

PineScript (risky):

// Decides on current bar close and assumes immediate favorable fill

long = close > ta.sma(close, 50)

if long

strategy.entry("L", strategy.long)

PineScript (safe):

// Confirmed signal from the previous bar; execute on next bar open

sig = ta.sma(close, 50)

long = close[1] > sig[1]

if long

strategy.entry("L", strategy.long, when=barstate.isconfirmed)

MQL (risky):

// Uses current bar's Close to decide and assumes instant fill at that Close

bool longSig = iClose(_Symbol, PERIOD_CURRENT, 0) > iMA(_Symbol, PERIOD_CURRENT, 50, 0, MODE_SMA, PRICE_CLOSE, 0);

if (longSig) OrderSend(_Symbol, OP_BUY, 0.1, Ask, 10, 0, 0);

MQL (safe):

// Decide on closed bar (index 1), place order; fill occurs on next tick

double cPrev = iClose(_Symbol, PERIOD_CURRENT, 1);

double maPrev = iMA(_Symbol, PERIOD_CURRENT, 50, 0, MODE_SMA, PRICE_CLOSE, 1);

if (cPrev > maPrev) OrderSend(_Symbol, OP_BUY, 0.1, Ask, 10, 0, 0);

2) Repainting Indicators

Symptom: An indicator changes its past values as new data arrives (e.g., ZigZag, some custom oscillators, HTF aggregation during the bar).

PineScript (risky):

// HTF series without confirmation can repaint intrabar

htfClose = request.security(syminfo.tickerid, "60", close)

long = ta.crossover(close, htfClose)

PineScript (safe):

htfClose = request.security(syminfo.tickerid, "60", close, lookahead=barmerge.lookahead_off)

// Only trust when the HTF bar has closed

confirmed = request.security(syminfo.tickerid, "60", barstate.isconfirmed)

long = confirmed and ta.crossover(close, htfClose)

Backtrader notes:

- Prefer indicators that don’t revise history. If an indicator needs the full bar (esp. High/Low), use previous values (

[-1]) for decisions. - Avoid mixing

cheat_on_openwith indicators based on the same bar’s Close/High/Low.

3) Multi‑Timeframe Leakage

Symptom: Using higher‑timeframe (HTF) values that are not yet finalized on the current bar.

Backtrader (safe pattern):

# Build HTF series via resample/replay and reference previous, closed value

cerebro.resampledata(data, timeframe=bt.TimeFrame.Minutes, compression=60)

def next(self):

htf_prev = self.data1.close[-1] # confirmed HTF close

if self.data0.close[-1] > htf_prev:

self.buy()

PineScript (safe): see the barstate.isconfirmed check above.

MQL (safe): decide using index 1 on HTF series so the bar is closed.

Quick Red Flags

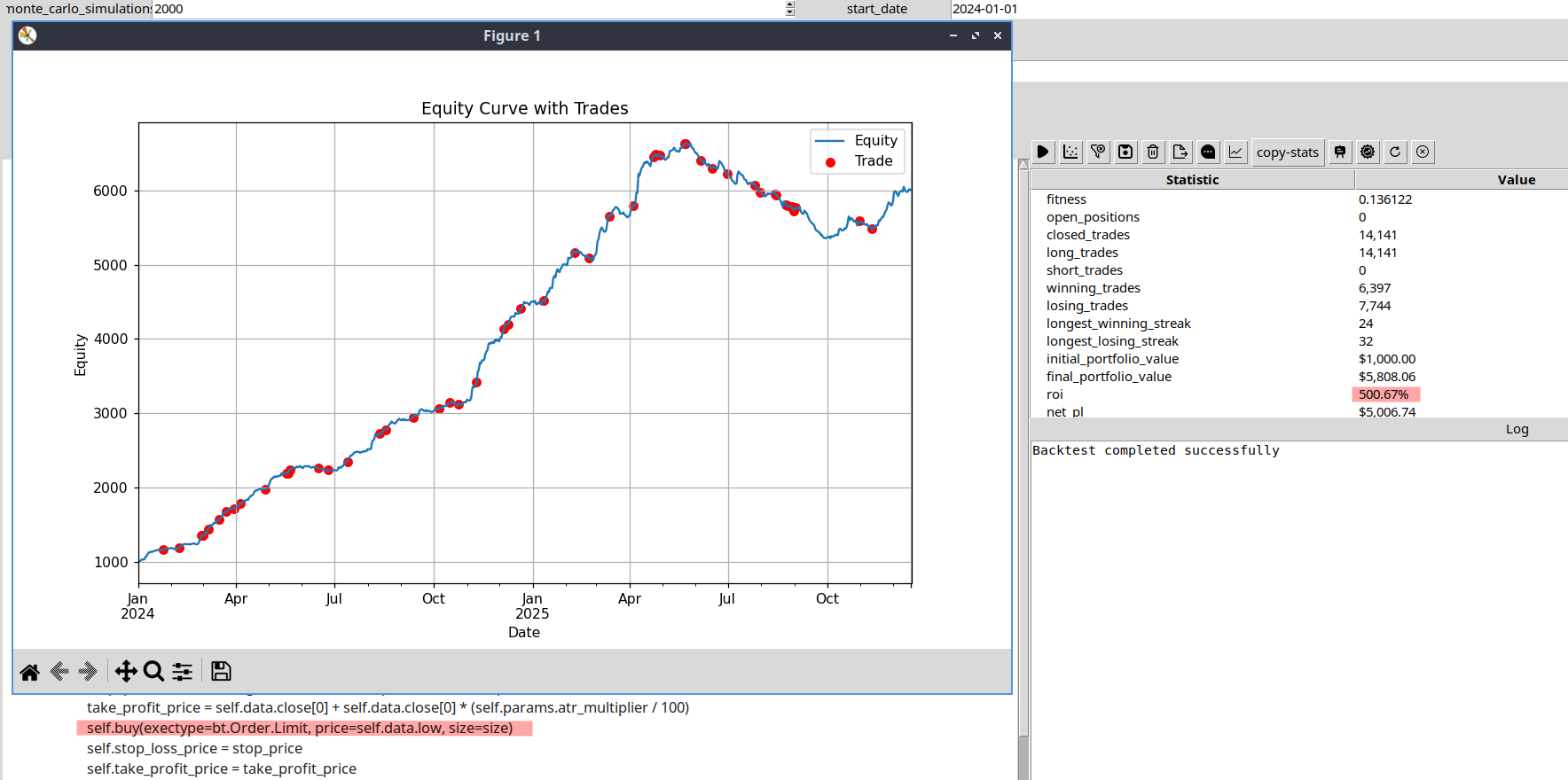

- Unrealistically clean equity curves, perfect tops/bottoms, or near‑zero drawdown.

- Signals change when you switch bar size but shouldn’t, given the logic.

- HTF logic looks amazing on LTF backtests but degrades massively live.

- Results collapse when you remove

coc/cheatfeatures or add tiny slippage.

Safe Defaults Checklist

- Decide on the previous bar; execute next bar open.

- Turn off “cheat on close” modes unless you truly trade the close with real constraints.

- Treat HTF values as valid only after the HTF bar closes.

- Avoid repainting sources; prefer non‑revising indicators or lock values once the bar closes.

- Model slippage/fees and ambiguous OHLC intrabar paths conservatively.

- Backtest again with smaller bar sizes (or intrabar data) to sanity check.

One‑Minute Sanity Test

- Remove any cheat‑on‑close options (

cerebro.broker.set_coc(False); PineScript rely on confirmed bars). - Add 0.05% slippage and real commissions.

- Shift all signals to use

[-1](previous bar) inputs. - Re‑run. If performance collapses, you likely had look‑ahead.

Closing Thought

Backtests don’t “firecast” the future—bugs do. If results feel too sharp for the logic, assume leakage until you prove otherwise with stricter timing, confirmed data, and conservative fills.